No, MetaMask does not require KYC. It is a non-custodial wallet, meaning users control their private keys and personal information is not collected.

Understanding MetaMask

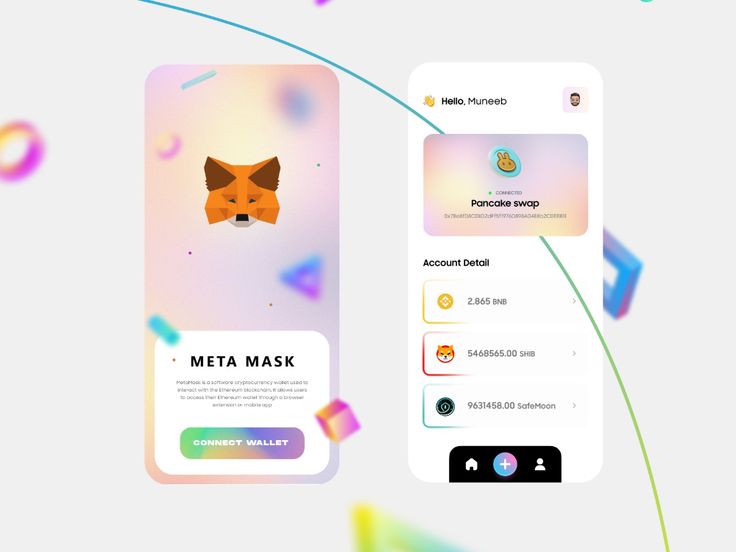

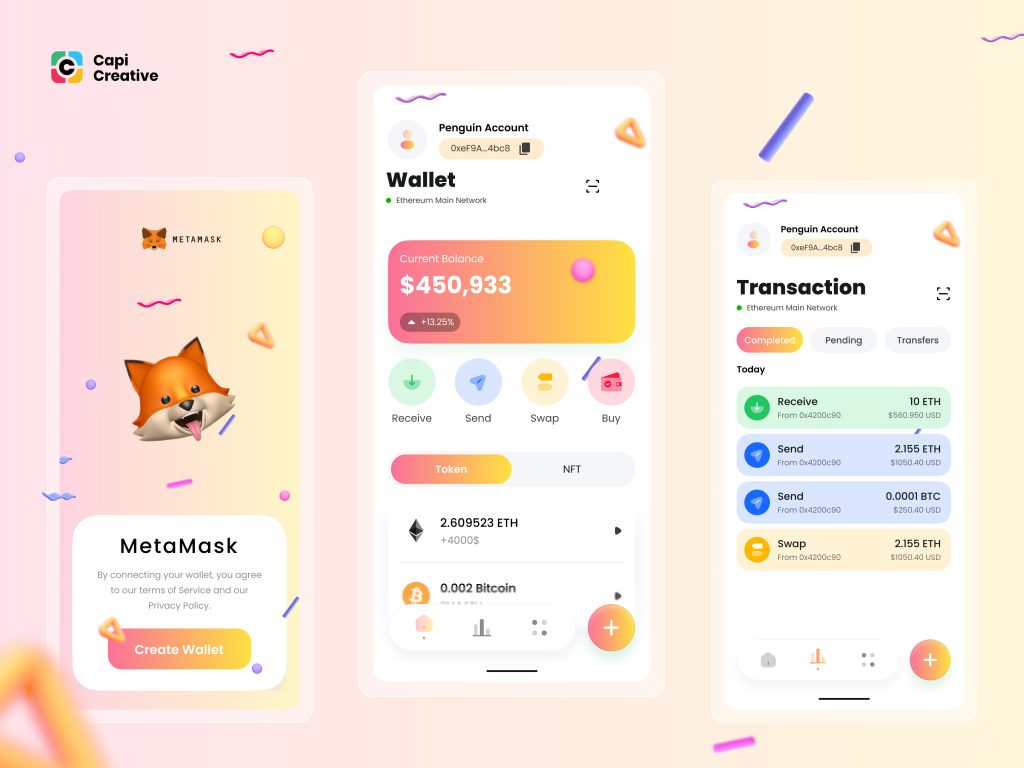

What is MetaMask?

MetaMask is a non-custodial wallet, meaning users control their private keys and funds. It operates as a browser extension and mobile app, supporting Ethereum and all ERC-20 tokens.

- User-Controlled Security: Users maintain control over their private keys, enhancing security.

- Decentralized Application Interaction: MetaMask allows users to interact with dApps, including trading on decentralized exchanges and participating in decentralized finance (DeFi) protocols.

- Seed Phrase Backup: A 12-word seed phrase is generated for wallet recovery and must be stored securely.

Key Features of MetaMask

MetaMask offers features designed to enhance the user experience and ensure the security of digital assets.

- Built-in Exchange Integration: Users can swap tokens directly within the wallet.

- Hardware Wallet Support: Compatible with hardware wallets like Ledger and Trezor for added security.

- Customizable Gas Fees: Users can set gas fees for transaction speed and cost control.

- Token Management: Automatically detects ERC-20 tokens for easy management.

- Security and Privacy: Includes phishing detection and the option to connect to custom RPC networks for enhanced privacy.

KYC in the Cryptocurrency World

Definition of KYC

Know Your Customer (KYC) is a process used by financial institutions and services to verify the identity of their clients. This verification process typically involves collecting personal information, such as identification documents and proof of address, to confirm the customer’s identity.

- Identity Verification: Involves collecting and verifying personal identification documents.

- Compliance Requirements: Ensures businesses comply with regulatory standards.

- Customer Information: Collects data such as name, address, and date of birth.

Importance of KYC in Finance

KYC is crucial in the financial sector to prevent illegal activities such as money laundering, fraud, and terrorist financing. It helps institutions build trust with their customers and comply with legal requirements.

- Fraud Prevention: Helps in identifying and preventing fraudulent activities.

- Money Laundering Prevention: Essential in combating money laundering and terrorist financing.

- Regulatory Compliance: Ensures that financial institutions meet legal and regulatory standards.

MetaMask’s KYC Policy

MetaMask’s Approach to User Privacy

MetaMask prioritizes user privacy by not requiring any personal information during account setup. As a non-custodial wallet, it allows users to control their private keys and manage their assets independently.

- Non-Custodial Nature: Users maintain control over their private keys.

- No Personal Information Required: MetaMask does not collect personal data during the account creation process.

- Enhanced Privacy: Users’ transactions and data are not stored on MetaMask’s servers.

Why MetaMask Doesn’t Require KYC

MetaMask does not require KYC because it operates as a non-custodial wallet, where users are responsible for their own security and asset management. This approach aligns with the principles of decentralization and user autonomy.

- Decentralized Philosophy: Emphasizes user control and decentralization.

- User Responsibility: Users are responsible for securing their own funds and private keys.

- Ease of Use: Eliminates the need for lengthy verification processes, allowing for immediate wallet setup and use.

Benefits of No KYC Requirement

Increased Privacy

Not requiring KYC enhances user privacy by eliminating the need to share personal information. This approach ensures that users’ identities and transactions remain more secure and less susceptible to breaches.

- Personal Data Protection: No need to submit personal documents or details.

- Reduced Risk of Data Breaches: Lower chances of personal information being compromised.

- Anonymous Transactions: Users can transact without revealing their identity.

Quicker Setup

Without the need for KYC verification, users can set up and start using MetaMask almost instantly. This convenience is particularly beneficial for those who want to quickly engage with decentralized applications and manage their crypto assets.

- Immediate Access: Users can start using the wallet right after download and installation.

- Streamlined Process: Simplifies the setup by eliminating verification steps.

- User-Friendly: Appeals to users who prefer quick and easy onboarding experiences.

Potential Risks and Drawbacks

Risk of Fraud

The absence of KYC can increase the potential for fraudulent activities, as there are fewer barriers to entry for malicious actors. Without identity verification, it can be easier for fraudsters to create multiple accounts and engage in deceptive practices.

- Increased Fraud Potential: Easier for fraudsters to operate anonymously.

- Lack of Accountability: Harder to track and prevent fraudulent activities.

- Trust Issues: Can lead to trust issues among users and service providers.

Lack of Account Recovery Options

Without KYC, recovering access to an account if the private keys are lost can be challenging. Users are solely responsible for securing their private keys, and there is no centralized entity to assist with account recovery.

- No Recovery Support: Users cannot rely on a service provider for account recovery.

- High Risk of Loss: Losing private keys means losing access to funds permanently.

- User Responsibility: Requires users to be diligent in managing and securing their keys.

Comparing MetaMask to KYC-Compliant Wallets

Security Features of KYC Wallets

KYC-compliant wallets offer additional security measures due to the identity verification process. These wallets often provide enhanced account recovery options and customer support, making them more secure for users who prefer added layers of protection.

- Enhanced Security: Identity verification reduces the risk of fraud and unauthorized access.

- Account Recovery Options: Easier to recover accounts with verified identity.

- Customer Support: Access to support services for resolving issues and queries.

- Compliance with Regulations: Ensures adherence to legal and regulatory standards.

Choosing the Right Wallet for You

When deciding between MetaMask and a KYC-compliant wallet, users should consider their priorities, such as privacy, convenience, and security needs. Each type of wallet offers distinct advantages and drawbacks depending on individual preferences and requirements.

- Privacy vs. Security: MetaMask offers more privacy, while KYC wallets provide enhanced security.

- Ease of Use: MetaMask allows for quick setup and use, whereas KYC wallets may involve a more complex verification process.

- User Responsibility: MetaMask users must manage their own security, while KYC wallets offer more support.

Future of KYC and MetaMask

Regulatory Changes

The regulatory landscape for cryptocurrencies is continually evolving, and future changes may impact KYC requirements for wallets like MetaMask. Governments and regulatory bodies worldwide are increasingly focusing on ensuring compliance and preventing illicit activities in the crypto space.

- Increased Regulations: Potential for stricter regulations to enhance security and prevent illegal activities.

- Global Compliance: Different regions may implement varying KYC requirements, impacting how MetaMask operates globally.

- Adaptation and Updates: MetaMask may need to adapt to comply with new regulations, potentially introducing some level of KYC in the future.

Impact on MetaMask Users

Changes in KYC regulations could affect MetaMask users by altering the balance between privacy and security. Users may face new requirements or changes in how they interact with the wallet.

- Privacy Concerns: New regulations might require some form of identity verification, impacting user privacy.

- Operational Adjustments: Users may need to comply with new procedures or provide additional information.

- Enhanced Security Measures: Potential improvements in security features to align with regulatory standards.

- User Experience: Possible changes in the onboarding process or additional steps for existing users.